A detailed analysis of the Azerbaijan startup ecosystem based on data scraped from startup.az.

📊 Dataset Overview

Total Startups Analyzed: 139 unique startups

Business Segments: 18 different industry sectors

Data Coverage: Complete segment information for 100% of startups

Certification Rate: 82.7% of startups are officially certified

Digital Presence: 87.1% have websites, 100% have email contacts

📈 Key Insights & Visualizations

1. Segment Distribution Analysis

Key Insights:

Marketing dominates the ecosystem with 33 startups (23.7% of total)

Transportation is the second-largest sector with 19 startups (13.7%)

Finance & E-commerce follows with 16 startups (11.5%)

Education sector shows strong presence with 14 startups (10.1%)

The ecosystem shows strong diversification across 18 different segments

Business Implications:

Marketing and advertising solutions are highly competitive in Azerbaijan

Transportation innovation is a key focus area, likely due to urban development needs

Digital transformation in finance and education sectors is actively pursued

2. Top Market Segments

Strategic Analysis:

Top 4 segments account for 58.6% of all startups

Marketing technology gap: High number of startups suggests market opportunity

Transportation innovation likely driven by Baku’s urban mobility challenges

Financial inclusion focus aligns with Azerbaijan’s digital banking initiatives

3. Startup Operational Status

Operational Health Insights:

69.8% (97 startups) are actively operating — indicating a healthy ecosystem

30.2% are in sales/scaling phase — showing growth orientation

Low failure rate suggests either strong market validation or early-stage ecosystem

Most startups have moved beyond MVP to operational status

Ecosystem Maturity:

High operational rate indicates good business model validation

Sales focus suggests market-ready solutions

Sustainable growth trajectory evident

4. Investment Landscape

Funding Ecosystem Analysis:

79.9% (111 startups) are not actively seeking funding — indicating:

Self-sufficient business models

Bootstrap/organic growth preference

Possible lack of venture capital ecosystem

20.1% (28 startups) are seeking funding — showing growth ambitions

Conservative funding approach dominates the ecosystem

Investment Implications:

Large untapped market for venture capital

Founders prefer bootstrapping or angel investment

Opportunity for impact investors in education and social sectors

5. Official Certification Status

Regulatory Compliance Insights:

82.7% (115 startups) are officially certified — excellent compliance rate

17.3% lack certification — possible early-stage or stealth startups

Strong government support for startup registration

Regulatory clarity encourages formal business establishment

Ecosystem Support:

Government policies facilitate startup formation

Clear regulatory framework

High formalization rate indicates mature business environment

6. Digital Presence & Accessibility

Digital Maturity Analysis:

100% have email contacts — universal digital communication

87.1% have websites — strong online presence

69.8% have phone contacts — preference for direct communication

60.4% have all three contact methods — comprehensive accessibility

Only 4.3% lack website presence — indicating digital-first approach

Market Readiness:

High digital adoption suggests tech-savvy entrepreneur base

Strong online presence facilitates international market access

Comprehensive contact options improve customer acquisition

7. Segment vs Status Performance Matrix

Cross-Sector Performance Insights:

Marketing startups show highest operational success (most are “İşləyir”)

Transportation sector has mixed performance — suggesting market validation challenges

Finance & E-commerce shows strong operational rates

Education sector demonstrates stable operational performance

Strategic Patterns:

B2B-focused segments (Marketing, Finance) show higher operational success

B2C segments require more time for market validation

Technology-enabled services perform better than physical product startups

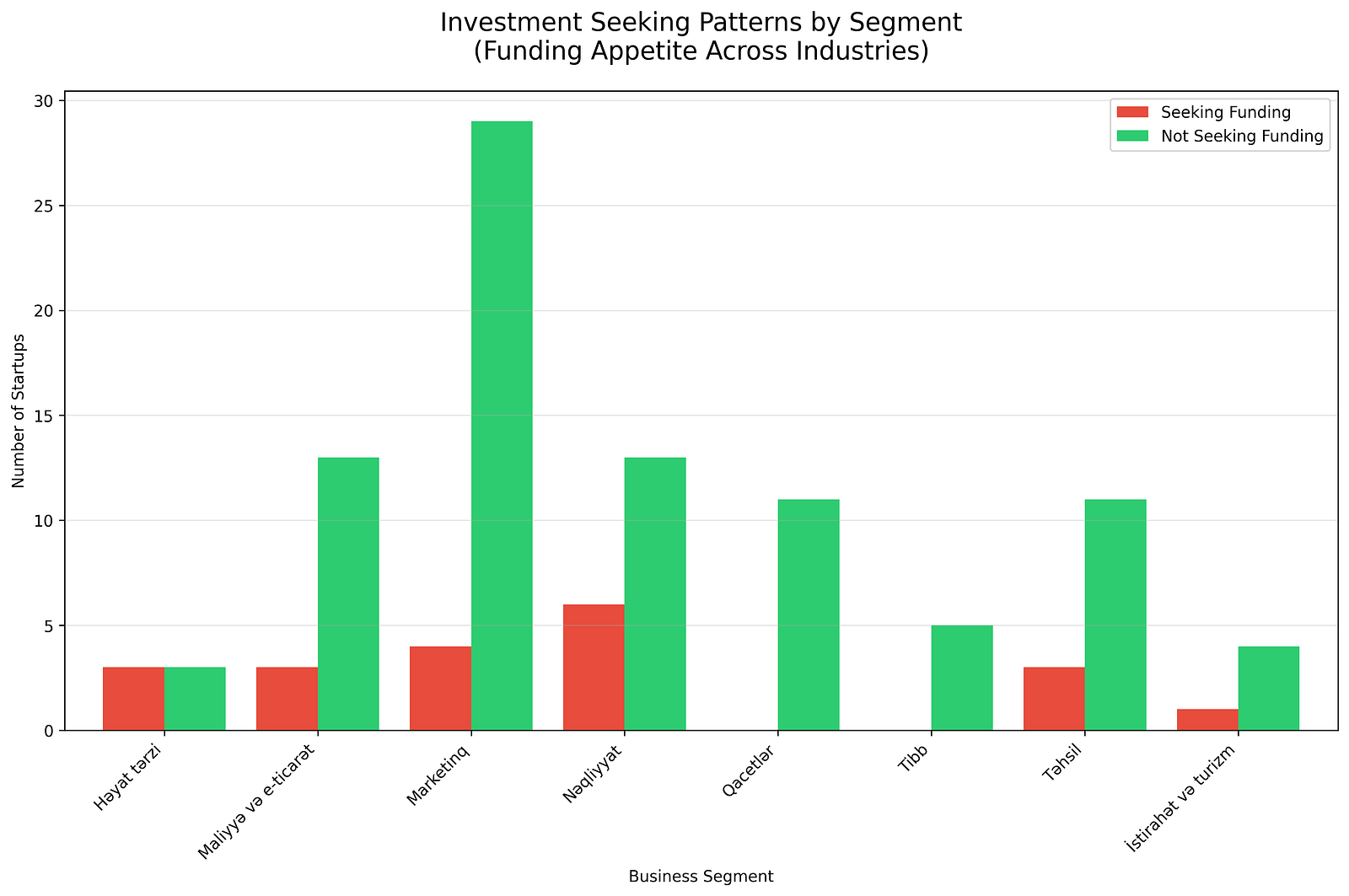

8. Investment Seeking by Segment

Sector-Specific Funding Analysis:

Transportation startups most funding-hungry — capital-intensive business models

Marketing startups least likely to seek funding — asset-light business models

Education sector shows balanced approach — mix of funded and bootstrap models

Finance startups prefer self-funding — regulatory capital requirements

Investment Strategy Insights:

Transportation sector offers highest growth potential but requires significant capital

Marketing/advertising provides quick ROI opportunities

Education sector balances social impact with commercial viability

🎯 Strategic Recommendations

For Entrepreneurs

Marketing/AdTech space is saturated — consider differentiation or adjacent markets

Transportation innovation has high potential — urban mobility, logistics, delivery

Education technology shows growth opportunity — digital learning, skill development

Financial inclusion remains underexplored — payments, lending, insurance

For Investors

High-quality deal flow in transportation — capital-intensive but scalable

Marketing startups offer quick exits — lower capital requirements

Education sector provides impact investing opportunities

82.7% certified startups — reduced regulatory risks

For Policymakers

Venture capital ecosystem needs development — only 20% seeking funding

High certification rate indicates effective startup support

Digital infrastructure is strong — focus on advanced tech adoption

Cross-sector collaboration opportunities exist

📋 Methodology

Data Collection

Source: startup.az official registry

Scraping Method: Python-based web scraping with BeautifulSoup

Data Quality: 100% segment extraction success rate

Deduplication: Smart algorithm removes duplicate entries while preserving data quality

Analysis Framework

Descriptive Statistics: Distribution analysis across all key dimensions

Cross-tabulation: Segment vs status performance matrix

Categorical Analysis: Investment patterns, certification status, digital presence

Visualization: Professional charts using matplotlib and seaborn

🔍 Key Findings Summary

Ecosystem Maturity: 69.8% operational rate indicates healthy business validation

Market Concentration: Top 4 segments represent 58.6% of ecosystem

Funding Gap: Only 20% actively seeking investment — VC opportunity

Digital Readiness: 87% website presence shows strong digital adoption

Regulatory Support: 82.7% certification rate indicates government backing

Sector Opportunities: Transportation (capital-intensive), Education (impact), Marketing (competitive)

🚀 Future Research Directions

Temporal Analysis: Track startup lifecycle and graduation rates

Geographic Distribution: Analyze regional startup concentration

Founder Demographics: Age, education, previous experience analysis

Success Metrics: Revenue, employment, export potential assessment

Ecosystem Gaps: Identify underserved market segments

Analysis generated from startup.az data as of September 2025. For questions or collaboration opportunities, please refer to the dataset and methodology sections.

Published

September 20, 2025